In choosing themes, I am honoring Wealth Wednesday. This is not my idea by any stretch of the imagination. But for following sovereignty and personal rights, our financial life is something we need to be paying attention to.

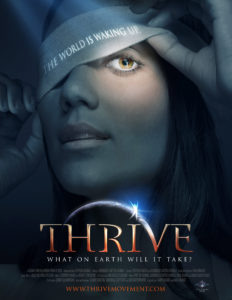

I have swiped a post from one of my favorite sites (www.thrivemovement.com). This it the official site of Foster Gamble for his documentary Thrive What on Earth Will It Take.

In the movie he makes the case for what we have to do to THRIVE in this world. The movie reveals some of the macro forces behind the financial elites in this country. And then suggests advice on how each of us can exercize our own personal sovereignty for the good of the Earth

BANK LOCALLY from www.thrivemovement.com

Align your money with your values.

Centralized banks are the main funders of environmentally harmful industries such as nuclear, coal, and clear cutting logging companies. They are also responsible for the most recent economic collapse that caused people around the world to lose their homes, their jobs, and their retirements. They use customer’s deposits to make these destructive loans. Are these the projects you want to keep supporting with your deposits? If not, then pull your money out of centralized banks and find a community bank or credit union that invests in good local community projects.

If you bank at one of the following banks – aka the “Tapeworm 20” – we recommend pulling your money out immediately and finding a better alternative.

1. Bank of America, US

2. JP Morgan Chase & Co., US

3. HSBC Holdings, UK

4. Citigroup, US

5. Mitsubishi UFJ Financial Group, Japan

6. Industrial and Commercial Bank

7. Wells Fargo & Co., US

8. China Construction Bank Corporation, China

9. Bank of China, China

10. Royal Bank of Scotland, UK

11. BNP Paribas, France

12. Barclays, UK

13. Banco Santander, Spain

14. Agricultural Bank of China, China

15. Credit Agricole, France

16. Sumitomo Mitsui Financial Group, Japan

17. Mizuho Financial Group, Japan

18. Lloyds Banking Group, UK

19. Goldman Sachs, US

20. UniCredit, Italy

A 3 Step-Guide to Move Your Money to a Local Bank:

1) Gather a list of local banks and credit unions.

You can usually come up with a list by calling your Chamber of Commerce, contacting a local credit union and asking about other local banks, or by using the yellow pages. Facebook and other friend-based social networks can help you learn which banks are best. Many local Banks and Credit Unions will also help you distinguish the real local establishments from those simply trying to sound community-based.

Don’t be fooled by the name…Union Bank of California is owned by Mitsubishi in Japan and funds some of the most destructive logging ventures on the planet.

if you live in the U.S., you can also enter your zipcode here to find local banks in your area. Another useful resource is moveourmoneyusa.org.

2) Evaluate the banks by calling around and visiting their websites.

The first and most important questions you want to ask are:

- What percentage of your money is loaned locally? (The more, the better)

- Are you owned by a bigger bank or do you intend to be bought-out? (If so, find a different bank)

- Are you FDIC insured? (Never put more than $250,000 in one bank)

3) Consider your own needs and what the bank offers to make your final selection. Is the bank doing what you care about and offering services that are important to you?

Some things you may want to consider:

- Does the bank have a good reputation in the community?

- Is the bank committed to supporting local businesses, environmental stewardship, social and economic equality, and other values of particular importance to you?

- Are employees at the bank paid well, local, diverse, and seemingly cared for in their jobs?

- Do they have sound business practices and financial statements? Analyze their annual reports.

- How close would you like the bank’s location to be to your home or place of work?

- What are the hours of operation? Does this work with your schedule?

- Does the bank have good customer service?

- What are their ATM fees? Are there multiple ATM’s in town?

- Can you access the bank or credit union through international ATM machines to make travel easy?

- What type of online banking services do they have?

- Is paperless billing an option?

- Do they have any mileage credit cards if that’s important to you?

- Can you apply to see what credit limit you qualify for before opening an account? If it’s lower than you current limit, ask if a transfer of credit is possible.

- What are their lending and investment services like?

- What are their Certificate of Deposit interest rates?

- What are their wire transfer fees?

If some of the services you have received from a large bank are not available, ask what they would need to implement the service. It may be that if enough customers show an interest and a commitment that the bank can accommodate a request. In our experience, this has been the case with waiving ATM fees, granting larger credit limits and providing international services.